Large-Scale Effort to Convert Commercial to Residential Gets New Initiative

Conversions Gain Federal and Local Support

Pamela Martineau • 6 min read

Office vacancies throughout the nation have reached a 30-year high and the country is amid an affordable housing crisis. These dual inflection points have increased housing advocates’ focus on conversions of commercial real estate into housing and encouraged federal and local governments to assist in the transformations.

Have an idea for an article?

We want to hear from you! Email us at info@taxcreditadvisor.com

Case Study

A Commerical to Residential Conversion

Jefferson Plaza Apartments in Woodbridge, VA

Mark Fogarty • 7 min read

The pandemic put a lot of stress on the retail sector, as health-conscious consumers turned to online shopping and started skipping trips to the local mall.

Case Study

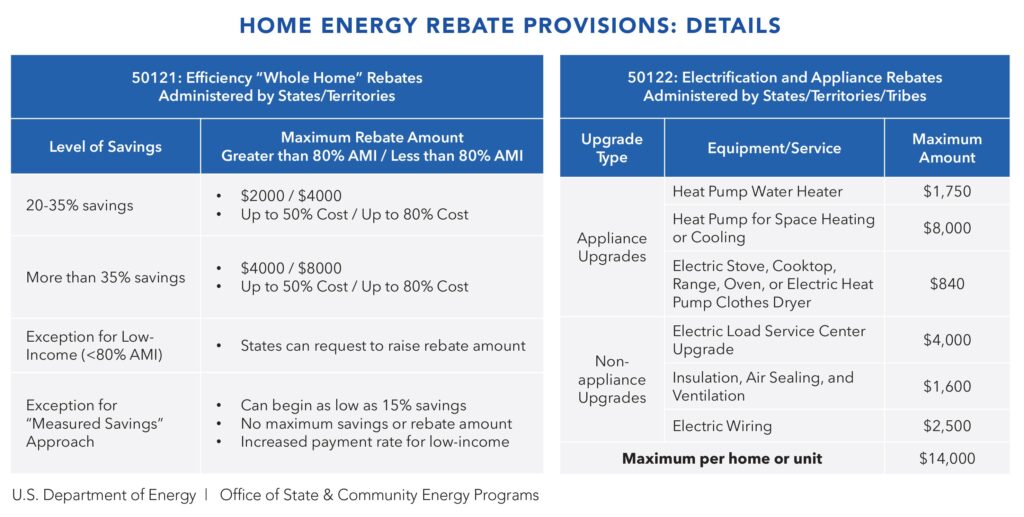

DOE Rebate Program Gives LIHTC Deal Incentives

Mark Fogarty • 7 min read

Developers of Low Income Housing Tax Credit projects are used to the concept of complicated capital stacks for their deals.

Breaking Ground

Joaquin Altoro, Administrator, Rural Housing Service, U.S. Department of Agriculture

Darryl Hicks • 11 min read

For nearly three decades, Joaquin Altoro has worked to understand and advance underserved communities, applying his banking and housing finance expertise to help drive economic opportunities at the local, state and national levels.

Housing Trust Funds Increase Affordable Housing for Lowest-Income Households

What is the National Housing Trust Fund?

Nushin Huq • 6 min read

The development and preservation of affordable housing units often require funding from multiple sources. One potential funding source for affordable housing developments for the lowest-income households is the National Housing Trust Fund.

A “Solution-Oriented” Approach to Today’s Housing Problems

The Michaels Organization Addresses Attainable Housing

Abram Mamet • 6 min read

The Michaels Organization has a history of identifying problems and forging ahead with bold solutions.

Creating Tailored Programs Setting a Course for the Fast-Evolving Incentives Landscapes

Influencing vs. Merely Accessing Available Funding

Ravi Malhotra • 2 min read

Government agencies are still racing to get their Inflation Reduction Act (IRA) and Bipartisan Infrastructure Law (BIL) funds out the door, and they remain open to input from various stakeholders to help guide this process.

NCHMA Establishes Guidelines for Housing Needs Assessments

Patrick Bowen • 4 min read

Given the housing challenges facing much of the nation, there are many communities, regions and even states around the country that are having Housing Needs Assessments (HNA) completed.

Monthly Columns

Industry Insights

Industry Insights

Final CRA Rule Implementation on Pause

Kaitlyn Snyder • 4 min read

A U.S. District Court for the Northern District of Texas recently granted an injunction to extend the Community Reinvestment Act final rule’s effective date, April 1, along with all other implementation dates. Here’s what you need to know about the case and how it will impact LIHTC investment.

Legally Speaking

Legally Speaking

Blending Yields

Alex Zeltser, Esq. & Robert Kaplan, Esq. • 7 min read

Due to the COVID-19 pandemic and resulting impacts on the economy and financial markets, as well as the Federal Reserve’s raising of short-term rates to stave off inflation, interest rates and construction costs have risen dramatically, resulting in funding gaps that many multifamily affordable housing developers in the four percent LIHTC space have had difficulty filling.

The Guru Is In

The Guru Is In

Neither Fair, Nor Market, Nor Rent

David A. Smith • 6 min read

Names can outlive their purpose and their original meaning. Though the Holy Roman Empire was neither holy, nor Roman, nor an empire, a cluster of mutually distrustful principalities with a largely symbolic head of state known as the Holy Roman Emperor maneuvered under that rubric for a thousand years after its 800 AD founding by Charlemagne before it was put to sleep by the 1815 Congress of Vienna. Such may yet be the fate of two venerable concepts, Fair Market Rent (FMR) and the Area Median Income (AMI).