Cost Containment Strategies

By Kyle Lui

3 min read

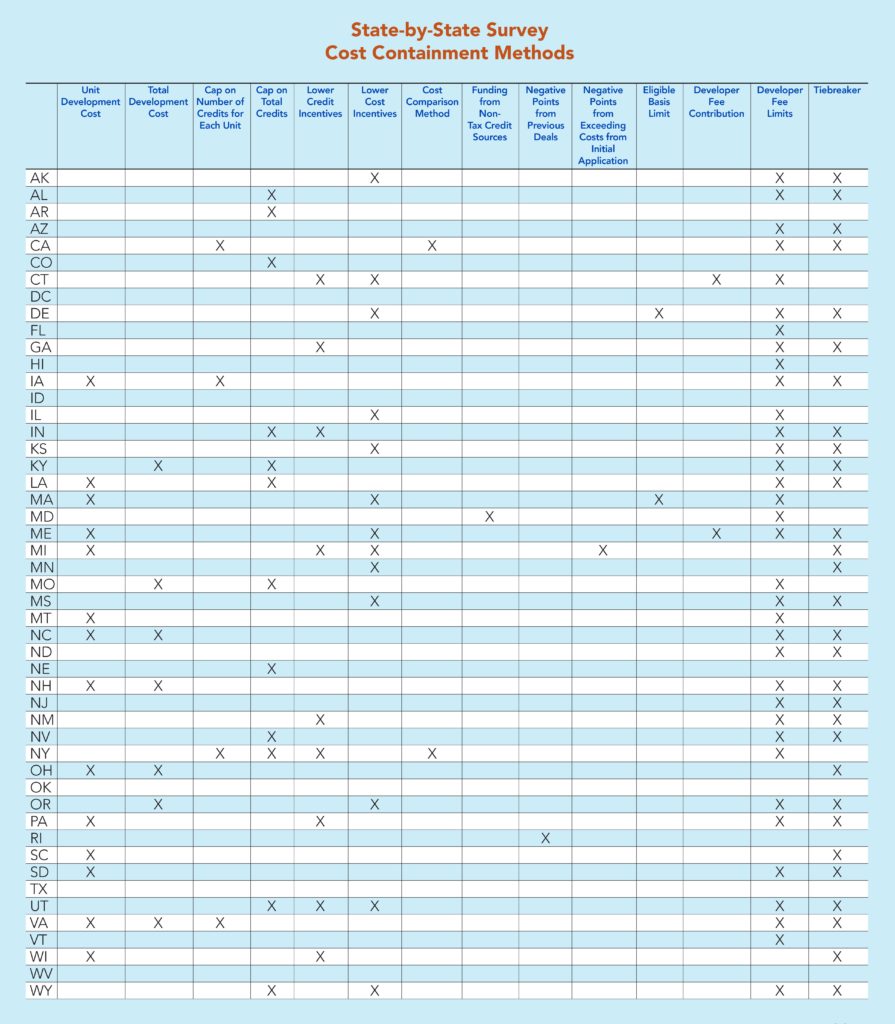

State-by-state QAP survey

It can be difficult to keep tabs on the strategies that housing finance agencies are utilizing in their Qualified Allocation Plans (QAP) to meet local housing needs since they vary from state-to-state. Awareness of cost containment requirements are vital since they are among the factors that play a role in the amount of tax credits each project will receive and thus determine a project’s feasibility.

To help clarify the range of requirements regarding cost containment, NH&RA conducted a research study documenting strategies in each state, as well as painting an overall picture of the popularity of specific strategies.

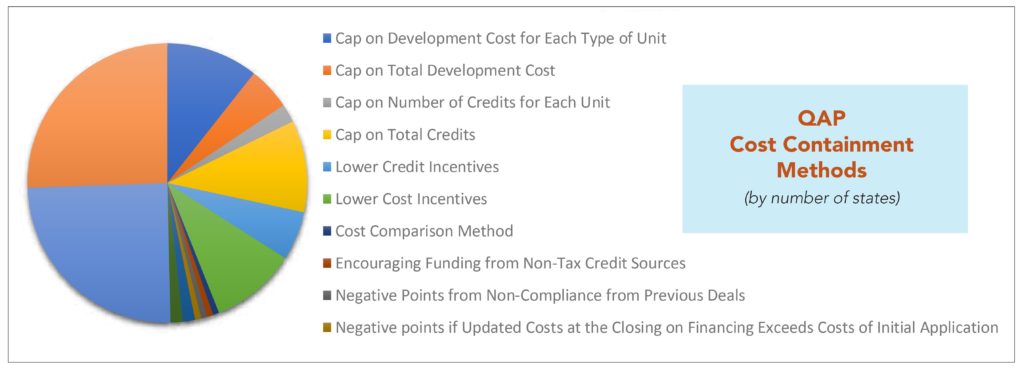

The research reveals that one of the most consistent cost containment strategies is the use of caps and limits:

- The most popular types of caps include one on the total credits requested for the project, as well as a cap on the development cost for each type of housing unit.

- There are also caps, albeit in fewer QAP’s, on the total development cost of the project, the number of credits that may be requested for each type of unit, as well as on the eligible basis.

- The incentivization of lower credits or lower cost in the competitive requirements is also quite popular. These competitive requirements grant applicants greater points in the competitive process if they request lower credits or incur lower costs relative to the rest of the applicant pool.

- Another strategy that is much less common allocates negative points for noncompliance when projects incurred higher costs in a past development project than the developer claimed to need in their application.

Many of the cost containment strategies in each state are embedded in each QAP’s tiebreaker policy:

- The most common cost containment strategy within state QAP’s is granting allocations to the project requesting the least amount of tax credits per low-income unit.

- Several tiebreakers grant tax credits to the project with the lowest cost per unit, the least amount of total tax credits per project, as well as the lowest total cost.

- Some less common cost containment strategies grant the tax credits to the project that has the most efficient use of tax credits, the project with the lowest intermediary costs, and the project with the lowest eligible basis per heated square foot.

Developer Fee Limitations

The National Council of State Housing Agencies (NCSHA) recently released its draft of the recommended practices in housing credit administration. In this draft, NCSHA listed the ways in which certain sections could be amended to make QAP’s more effective and efficient. One of the draft’s recommendations is to impose a limitation on developer fees, both as a cap calculated by a percentage of total development and as a per unit or per project dollar cap. The majority of QAP’s are consistent in the first recommendation, but less than half of the 50 states have a per unit or per project dollar cap.