Income Averaging Generates Workforce Units

By Mark Fogarty

4 min read

Makes Projects More Feasible, Retains Residents As Careers Improve

Income averaging can be a considerable help in increasing the number of workforce housing units available to those who don’t qualify for subsidies and cannot afford market rates. And having units available to tenants at more than 60 percent of area median income (AMI) contributes new flexibility for making projects more feasible and keeping them affordable.

The Park Avenue West project in Denver, for instance, has been able to raise an additional $5 million in equity to rehab 122 units and preserve affordability when its developer converts all 50 of the market-rate units in the project into housing at between 60 and 80 percent of AMI. These units are being cross-subsidized with very low-income units to keep the average AMI within the 60 percent limit.

The additional $5 million will just about cover the $5.25 million in planned rehab costs for the project re-syndication, says Russell Condas, senior development associate at the Broomfield, CO office of Dominium, the Plymouth, MN-based affordable housing developer and manager. That will enable a $43,000 facelift for each of the 122 units, originally built in 2004 using nine percent Low Income Housing Tax Credits (LIHTC) and now past the initial compliance period.

The rehabs will “replace a lot of the long-term bigger capital items, like a new roof, new siding and new HVAC equipment,” Condas says. It also will include items like LED lighting fixtures and low-flow plumbing closets and new counter tops. Dominium plans to have the rehabs done by the end of the first quarter of 2020.

“Without income averaging (IA), we would not have the capital to preserve and rehab this property,” he says. Park Avenue West “was a perfect chance to maximize the potential of the income averaging program.”

Without IA, Dominium might have sold the project to someone and seen it turned into all market-rate units, Condas says. The project will remain owned by Dominium-controlled entities after the acquisition.

Financing Package

Dominium has a signed letter of intent with the Colorado Housing and Finance Authority for four percent tax credits and tax-exempt bonds for the project, but has not yet closed on it.

Total financing for Park Avenue West is $38 million, consisting of a permanent Freddie Mac tax-exempt loan, four percent LIHTC equity, seller financing, a Denver Office of Economic Development loan and deferred developer fees.

The set-asides for the 30 percent, 40 percent and 50 percent units will not change. After the re-syndication, the number of 60 percent units will increase from 26 to 38 and there will be 38 80 percent units, squarely in the workforce housing range. With an applicable fraction of 59 percent (72 divided by 122), the project will come in averaging exactly 60 percent.

At 80 percent AMI, renters can qualify if they have incomes of $50,400 (one person) to $71,920 (four persons).

IA Retains Current Residents

Affordability is “a very hot button topic” in Denver’s high-cost housing market, says Condas. He notes 80 percent rents would have a 19 percent advantage to market and 60 percent rents a 39 percent advantage for Park Avenue West.

“As it relates to the workforce housing, not only does it reach that population, but it also preserves the ability for a lot of those residents to actually stay on the property,” says Jen Brewerton, vice president of compliance at Dominium.

That’s because “they are above 60 in those market-rate units, and we don’t even need to reach out to identify those 80 percent units. They are already residing on the property. It avoids displacement and relocation, too.”

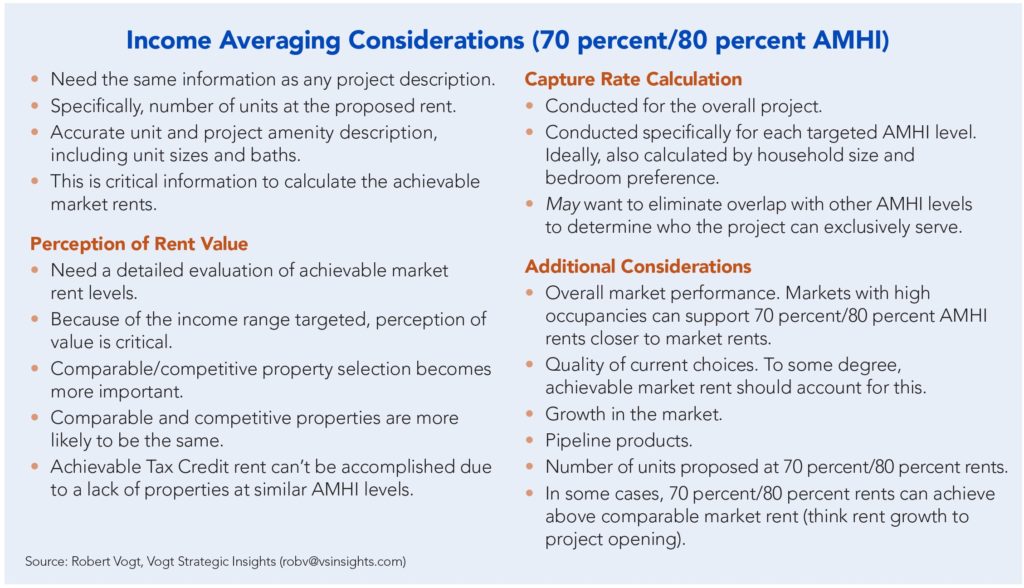

The challenges of IA are lack of IRS guidance, state agency implementation, investor uncertainty/pricing expectations and industry interpretations, according to a presentation Brewerton gave to the recent National Council of Housing Market Analysts annual meeting in Atlanta.

Dominium’s goals for IA are to advocate with state HFAs to follow the federal guidelines, allow for as much flexibility as possible, not to limit to less than 60 percent AMI, not to map incomes to specific units in land use restrictive agreements, to check the IA set-aside on as many form 8609s as possible and to exercise due diligence and create strong policies to maintain compliance, according to her presentation.

Brewerton says agencies are getting comfortable with IA. She says 38 states are allowing it, and only four states have said no. There are only a couple of gray areas left, she says. In fact, getting investors comfortable with the concept is more of a roadblock than the state agencies.

“That’s the next step we’re trying to get to, their comfort,” she adds.

Story Contacts:

Russell Condas

Senior Development Associate, Dominium, Broomfield, CO

rcondas@dominiuminc.com

Jen Brewerton

Vice President, Compliance, Dominium, Plymouth. MN

jen.brewerton@dominiuminc.com