Social Impact Investing: The Trend Towards Resident Services

By Douglas P. Koch

8 min read

Housing is Just a Component of a Bigger Vision

The evolving social impact financing market is an alternative source of funding for Low Income Housing Tax Credits (LIHTCs). As I reported here four years ago, some organizations successfully raised and deployed socially responsible capital resulting in significant development and community impact for affordable housing and community development. But in today’s market, we are seeing affordable housing and community development organizations using such investing to integrate development with resident services to provide significant social impact. It’s less about bricks and sticks and more about confronting the challenge and opportunity of attracting impact investors interested in the efficiencies and successes of resident services programs affiliated with affordable housing development.

The Global Impact Investing Network (GIIN – https://thegiin.org/) defines impact investments as those made with the intention of generating positive, measurable social and environmental impact alongside a financial return (Triple-bottom line). GIIN further specifies four key elements to differentiate impact investments from other classes of socially responsible investing: intentionality, financial returns, range of asset classes and impact measurement.

The 2019 GIIN investor survey identified $239 billion in impact investments under management. The investors who participated five years ago grew their Social Investment Fund (SIF) platforms by 13 percent annually. The 2019 respondents plan to increase their investments by 13 percent in 2019. The Social Investment market potential is “$3 trillion of venture capital and private equity,” according to the Global Social Impact Investment Taskforce. Only 28 percent of the 2018 assets under management (AUM) were in the U.S. and Canada, but 47 percent of respondents had investments in both countries.

Only seven percent of the 2018 AUM was in the housing sector, but 39 percent of respondents had investments in housing. Planned 2018 investments in child welfare, education and healthcare (as an indicator of resident social services) combined were at ten percent but not prominent. Thus, the market is growing, and investors acknowledge the housing and resident/social services space, but it is not a priority. We can increase impact investing in these sectors by using the linkage between housing and resident services.

Over the last 30 years of the LIHTC, the industry has evolved well-documented and integrated resident services programs (RSP). About a quarter of all LIHTC developments provide RSP—linking the affordable housing delivery system, its investors, syndicators, developers and state agencies—to RSP. A number of industry-related organizations developed methods for measuring the impact of resident services combined with affordable housing.

There is significant potential to convert this measurable success into significant project and program capital/funding through social impact investors on the project, property management, financial intermediary and investor level. (Each partner in the system.) There is certainly enough familiarity with funding requirements, and resident services are established enough to aggregate into scalable format across either a property management, syndicator, owner or even investor platform.

Pay for Success

Some of the vehicles that represent opportunity for converting savings and impact from resident services include pay for success (PFS), as well as funds attracting service-oriented capital along with asset-based capital.

PFS monetizes government or funder savings for core social welfare or housing-based service programs resulting from a specific impact investing intervention measured by a third-party evaluator. It includes the following participants and processes:

Organizations, such as Third Sector Capital, succeeded in working with investors and federal and state government initiatives to create effective PFS projects. A number of funds using social and housing capital also are integrating resident services with affordable housing optimizing impact on resident lives in breaking the cycle of poverty, providing stability to formerly homeless households, improving childhood education and impacting community revitalization. The question is, how do we efficiently assimilate these programs with affordable housing and how do we scale up these services?

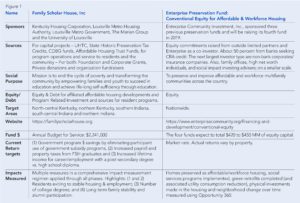

Examples: Enterprise & Family Scholar House

Enterprise Community Investment, Inc., through its Enterprise Preservation Funds, offers conventional equity for affordable and workforce housing that provides a triple bottom line return. Family Scholar House, Inc. (FSH) serves the residents at affiliated affordable housing communities, working alongside property management in attracting service-eligible residents who participate in a comprehensive, integrated housing-services model.

Family Scholar House

How do you integrate educational programs and advocacy services into the daily lives of underserved single parents and their children without living it 24 hours a day? You can’t. That is why Riverport Landings in Louisville was developed alongside a holistic two-generation services model implemented by FSH. Founded in 1995, FSH works with underserved single parents and their children, meeting them where they are and supporting them as they set and attain educational, career and personal goals, enter the workforce, establish financial independence and build assets.

Jacob Brown, Chris Dischinger and Mark Lechner, principals for Marian Development and LDG Development, sponsored the 2018 development of Riverport Landings, working alongside FSH designing a community complimentary to FSH’s programmatic mission and needs. Cathe Dykstra, chief possibility officer and president and CEO of FSH, summed up the housing-services link, “Partnerships with high-quality developers, like Marian and LDG, drive the expansion of physical sites to fulfill the needs of our families and young adults. We are not a housing program. We are an educational program with a housing component. Our partners allow FSH to focus on its mission and the housing component helps disadvantaged single-parent families and young adults foster alumni transition from poverty and homelessness to financial independence and gratitude. Access to stable, affordable housing means these families and young adults can focus on graduating from college and looking forward to a future that includes self-sufficiency, home ownership and success.”

Combining both a pre-residential program phase along with a residential phase, FSH in 2018 served 3,962 disadvantaged single parents with 5,179 children, 455 foster care alumni and 112 senior citizens. FSH parent scholars earned 502 college degrees and 50 FSH children followed their parents, pursuing their own post-secondary educational goals. Fifty-three families purchased homes through FSH’s homeownership program.

FSH evolved and perfected its comprehensive, holistic two-generation model to break the cycle of poverty for the program parents and children for generations. The program’s intensive nature is cited by participants as a primary reason for their success. However, FSH acknowledges that the success belongs to the parent scholars and their children along with the participating, self-reinforcing model that requires and embraces parent, child, program alumni and FSH professional participation.

Enterprise Preservation Funds

As a leader in affordable housing and community development investing, Enterprise Community Investment, Inc. invested over $43.6 billion, creating over 585,000 homes over the last 35+ years. In 2013, it created its first conventional equity fund for affordable and workforce housing, and it is raising a series of four different funds that follow a similar strategy. Registered on Impact Base, a GIIN-sponsored Impact Investing Fund database, (https://www.impactbase.org/) as “The Enterprise Multifamily Opportunity Fund,” the Fund addresses the need for a new source of capital to preserve affordable and workforce rental housing while providing a risk-adjusted return to investors, maintaining rents affordable to working families, improving the assets’ physical condition to ensure long-term stability, reducing the environmental footprint of the property through green improvements and helping to stimulate economic development in the surrounding community.

Enterprise reports that its four funds are expected to total more than $420 to $450 million of equity capitalization by the end of 2019. Since 2012, Enterprise’s funds have acquired and preserved 70 developments with nearly 9,000 units of housing. These funds target risk-adjusted market rates of return for its investors, including net cash-on-cash returns of six to seven percent and overall net returns of eight to 11 percent.

Like other social impact investments, the Fund seeks a triple bottom line with environmental, social and economic returns. For one property investment, water, electricity and gas usage declined 39, 37 and 26 percent, respectively, between 2013 and 2016. About 50 percent of the developments provide resident services. The Fund measures social impact through Enterprise’s exclusively developed “Opportunity 360 Measurement Report,” which “provides a comprehensive approach to understanding and addressing community challenges using cross-sector data, community engagement and measurement tools.”(www.enterprisecommunity.org/opportunity360.) The tool is used to measure a before-investment and after-investment impact to a specific geographic area and its residents based on employment, environmental, community institutions, social capital and cohesion, housing market, housing stock and mortgage market parameters.

Chris Herrmann, vice president at Enterprise Community Investment, Inc. stated, “Through Enterprise’s conventional equity funds, investors and developers have a partner with a balanced and responsible approach to affordable housing preservation. In our portfolio, we balance socially responsible impact with the highest possible risk-adjusted return on investment. We aim to deliver responsible housing preservation while stewarding consistent, cash returns.”