The Loop at Mattapan Station

By Mark Fogarty

5 min read

Transit-Oriented Development on Boston’s Red Line

Income averaging has achieved tax credit eligibility for all 135 units, including workforce housing units at up to 80 percent of area median income (AMI), at a development set to rise from a Boston trolley parking lot.

Thirty of the units now being built in the Boston neighborhood of Mattapan will be workforce housing and were included in Low Income Housing Tax Credit (LIHTC) financing, as some units will be at 30 percent and 50 percent of AMI, making the average of all units comply with the 60 percent LIHTC restriction.

MassHousing Executive Director Chrystal Kornegay notes the affordable housing agency in recent years has been working on an initiative to fund 1,000 workforce housing rentals. It has actually exceeded its goal by more than 200 units but will continue to target the workforce niche. The agency is also starting a homeownership program for workforce housing, she says.

Kornegay notes approvingly the number of different AMI levels at the six-story project. “MassHousing was founded in order to do mixed income projects,” Kornegay says. “We see this as keeping to our roots.”

The $73 million rental project is being built in an underused parking lot adjacent to a Massachusetts Bay Transit Authority Red Line trolley. With the trolley and a bus line immediately adjacent to the building, The Loop qualifies as a prized transit-oriented development (TOD).

Kornegay characterizes a project with many income levels near mass transit as “a slam dunk” for the agency.She also lauds the green (passive house) building aspects of the development as helping achieve a positive impact on climate change.

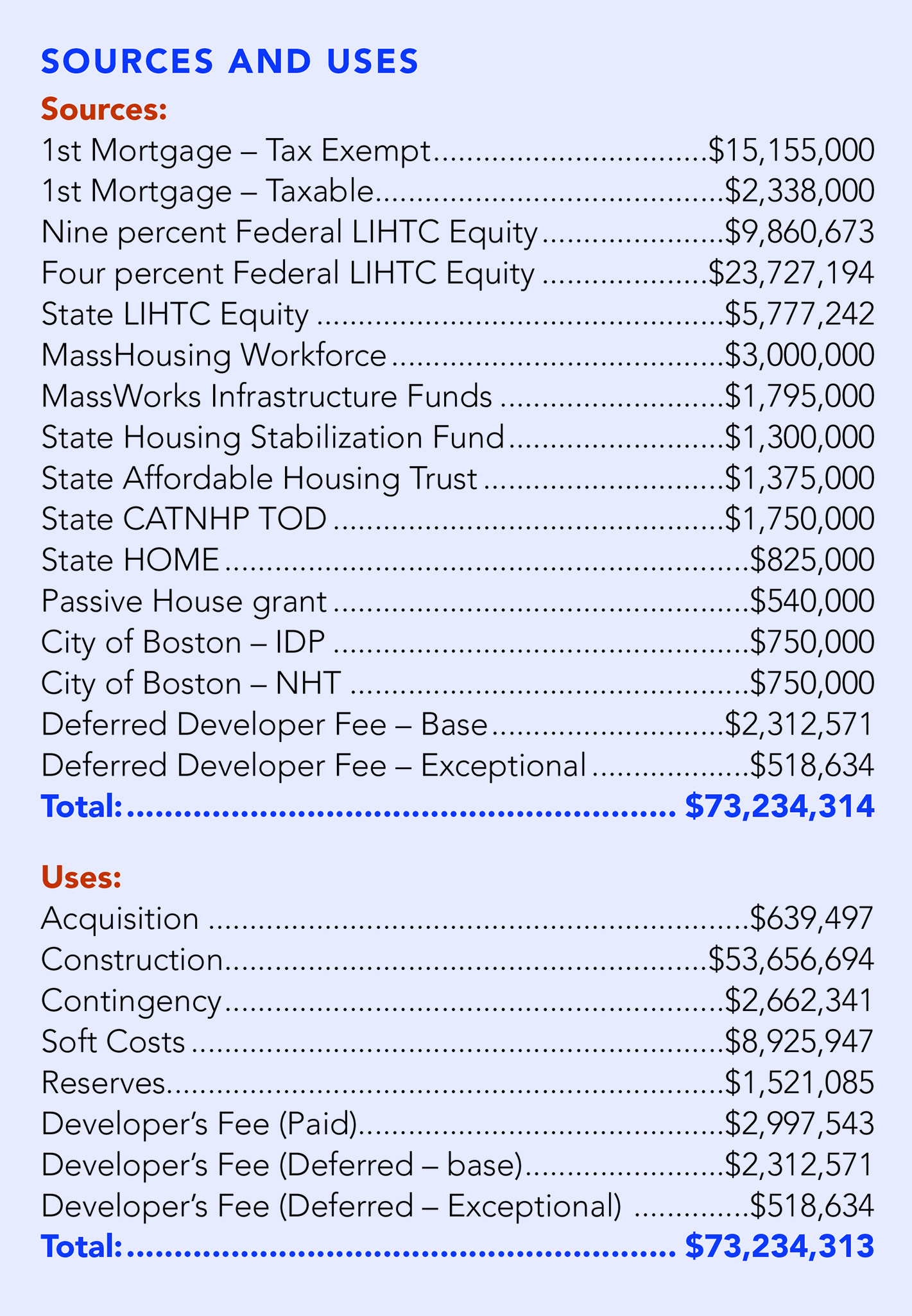

While all affordable housing tends to have complicated financing structures, The Loop is more complicated than most, featuring 15 separate sources of funding (see accompanying table), including both four percent and nine percent LIHTCs (Bank of America is the investor, and also provided construction financing).

Mixed-Income, Mixed-Use

In addition to mixed-income, the development will also be mixed-use as the ground floor will contain 10,000 square feet of commercial space. The developers are two nonprofits, Preservation of Affordable Housing (POAH) and Nuestra Comunidad Development Corp.

The neighborhood is quite diverse, with many residents of Haitian and other heritages and a mix of languages, says Cory Fellows, vice president of real estate development at Boston-based POAH.

POAH did a lot of community outreach and predevelopment for the project (Nuestra Comunidad facilitated a lot of the community feedback) and found residents were eager for housing development.

“It’s clear there was a lot of interest and a pent-up demand for this kind of housing and the commercial development we’re planning,” he says.

He notes that the site is a largely empty parking lot, making for less complicated site development. Some spaces (50) will be left for Red Line commuters, who take the trolley into Boston or other nearby communities.

Residents will have their own separate place to park.

The site backs up to the Neponset River, Fellows says, meaning residents will be near a walking and biking path and a bridge over the river.

Twinning the Tax Credits

Fellows remarks on the complexity of the many different funding sources, especially the “twinning” of four percent and nine percent LIHTCs, including separate condos established for each type of credit.

He says the project “certainly was worth the extra heartburn. It definitely took a lot of mental gymnastics in coordination with different people.”

Bank of America is providing the construction funding. The loan closed around Thanksgiving of 2020 and construction is now under way.

Studios will be around 500 square feet (sf) and rent for $1,700 in the expensive Boston market (the AMI for Boston is $119,000 for a household of four). One-bedroom apartments of about 640 sf will go for $1,900, two bedrooms at 870 sf will rent for $2,400, and the three-bedroom units, at about 1,400 sf, will go for $3,000.

Plans call for six studio apartments, 38 one-bedroom units, 81 two-bedroom apartments and ten three-bedroom units.

MassHousing says 18 apartments will be restricted to very low-income households earning at or below 30 percent of AMI.

“Those units will be supported by project-based vouchers through the federal Section 8 and the Massachusetts Rental Voucher Programs,” according to the agency.

AMI Breakdown

“There will be 47 apartments restricted to households earning at or below 50 percent of AMI, 28 apartments restricted to at or below 60 percent of AMI and 42 apartments restricted to at or below 80 percent of AMI, of which 30 will be designated as workforce housing units.”

MassHousing provided a total of $36.5 million in financing to POAH affiliates. The agency funded POAH with a total of $17.4 million in permanent financing, $16.1 million in tax-exempt bridge financing, and $3 million from the agency’s Workforce Housing Initiative.

It says other financing sources include $39.3 million in tax credit equity from an allocation of LIHTCs, both four and nine percent, allocated by the Massachusetts Department of Housing and Community Development. DHCD also provided $5.35 million in direct support for the project. The City of Boston contributed $2.9 million in affordable housing funding. The project also received $1.8 million in public infrastructure funding from the state, and $540,000 in passive house funding from the Massachusetts Clean Energy Center.

The general contractor for the building is Dellbrook/JKS. MacKay Construction will complete the infrastructure work. The architect is The Architectural Team and the management agent will be POAH Communities, MassHousing announced.

With an 18-month build scheduled, resident move-in should happen by summer of next year, Fellows says.

“In a perfect world, we’d also have at least one commercial tenant in place by then.”

A video overview of the project is available at

Story Contacts:

Chrystal Kornegay, Executive Director, MassHousing, Boston, ckornegay@masshousing.com

Cory Fellows, Vice President, Real Estate Development, Preservation of Affordable Housing, Boston, cfellows@poah.org