The High Demand for Green Bonds

By Christian Robin

2 min read

New Fannie Mae & Freddie Mac support consumption reduction

For those developers interested in implementing water or energy improvements during rehabilitation, Fannie Mae’s Green Regards and Freddie Mac’s Green Advantage offer innovative new funding options. With interest savings in the neighborhood of 13 – 39 basis points off of a fixed rate loan, these products are in high demand.

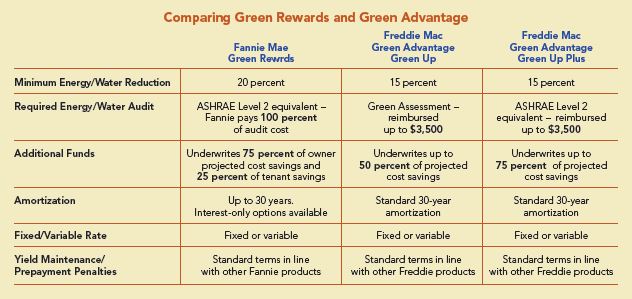

Both products require minimum reductions in water or energy consumption, but the minimum can be reached through any number of improvements – from a new roof, improved insulation, efficient windows, or LED lights, to overhauling inefficient HVAC systems or installing water efficiency products. Potential improvements are readily apparent in a required energy/water audit report which provides developers with an analysis of consumption savings and associated costs for each improvement. Some developers will intentionally go beyond the minimum required consumption reduction amount when they see the savings the improvements will bring in the long run. The cost of the required audit itself is also partially or fully reimbursed, depending on a few factors outlined in the chart below.

Freddie offers two products, Green Up and Green Up Plus, while Fannie offers Green Rewards, which is suitable for a broad clientele, as well as Green Preservation Plus, which is offered exclusively to affordable multifamily developments (benefits include up to 85 percent LTV and a debt to service coverage ratio as low as 1.15).

JLL International Director of Capital Markets Tim Leonhard says that the costs of improvements are often recovered quickly and that a large majority of sponsors he’s working with are using one of these green products. With high demand for the programs—volume for green products in 2016 accounted for over $3 billion each at Fannie and Freddie—Leonhard anticipates the GSEs to implement higher standards for participation in 2017. The products are also exempt from the GSE’s annual production caps, giving them incentive to do as much as possible.

Buildings constructed before 2005, and especially much older buildings, can often present prime opportunities to utilize these products, as the buildings’ efficiencies may be so poor that reaching the minimum consumption reductionis not a stetch. For properties in your portfolio with a qualifying green certification, Fannie and Freddie offer preferential pricing as well.