Making TOD a Reality through TIFIA

By Kaitlyn Snyder

3 min read

Transit-Oriented Development (TOD) has long been touted as an urban planner’s dream with reduced car dependence via housing located near public transit. Quadruple bottom line win: good for the environment with fewer cars on the road; good for the city with less need for street parking and increased ridership; good for the residents by needing fewer or potentially no cars; and good for the developer who needs to build fewer parking spots.

As beneficial as these properties are, they are often hard to finance. In the DMV area (District of Columbia, Maryland, Virginia), land prices soar whenever a new metro stop is announced; even the possibility of a potential metro stop can create a bidding frenzy. Many Qualified Allocation Plans (QAPs) around the country incentivize proximity to transit but stop short of offering any additional resources to compete with market-rate buyers interested in the same piece of land. And while none of those fundamentals have gone away, there is a new resource on the table to help make these deals possible: the Transportation Infrastructure Finance and Innovation Act (TIFIA).

The bill was first passed in 1998 and has primarily been used to finance highway, bridge, ferry and rail projects. The Infrastructure Investment and Jobs Act (IIJA) expanded the program to finance up to 49 percent of eligible project costs for affordable housing located near transit. To tap into this program, properties must be located within one-half mile of a fixed guideway transit, intercity bus, intercity passenger rail or intermodal station.

TIFIA has $50 billion in authority and can finance projects via direct loans, loan guarantees and lines of credit. TIFIA triggers Davis-Bacon, Build America Buy America, National Environmental Policy Act and Uniform Relocation Assistance Act requirements. It also requires an investment grade rating of at least BBB-.

And yes, that is a lot of strings. As of July 28, the interest rate for a 35-year loan is 4.03 percent with no pre-payment penalties, and a five-year repayment deferral following construction completion. The Build America Bureau loan programs are highly customizable to meet borrower cash flows and needs and interest accrues as funds are drawn. Those strings should be more palatable now.

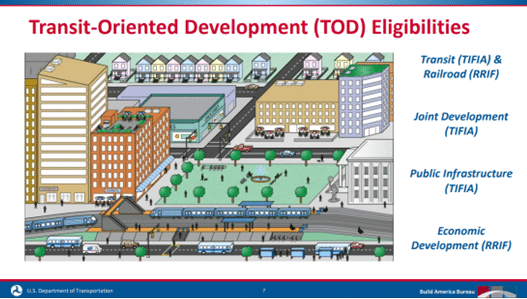

Daniel Schned is head of project development at the Build America Bureau within the Department of Transportation and attended National Housing & Rehabilitation Association’s Summer Institute – his presentation is available in NH&RA’s On-Demand Learning System. One of his slides resonated, the Bureau can help finance just about everything in this graphic.

TOD is new to housing and especially to the intricacies of affordable housing. Several projects are in the pipeline, but none have been closed yet. Build America Bureau staff are available for consultations and actively soliciting TOD deals. The program is still being stood up and rules are still being developed, so the Bureau is highly flexible and able to design customized solutions in order to get deals closed. I encourage you to reach out to them if you have a deal that might meet these parameters. Beyond TIFIA, Bureau staff can also share details about how Railroad Rehabilitation & Improvement Financing (RRIF) can be used to finance affordable housing.

In an otherwise difficult development cycle, this stands out as a bright spot with the potential to unlock a new, low-cost financing option while delivering a quadruple bottom line win.