Return of the LIHTC/Historic Tax Credit Master Lease Pass-Through Structure

By Kaitlyn Snyder

2 min read

In a financial environment that is challenging for getting deals to the closing table, all sorts of structures that might generate additional proceeds need to be considered. A presentation from National Housing & Rehabilitation Association’s 2023 Fall Developers Forum pinpointed one that might seem unwieldy at first, but might also provide a viable solution in some cases.

Katie Day with Klein Hornig and Nick Ratti with CohnReznick covered the resurgence of the master lease pass-through structure for deals with both Low Income Housing Tax Credits (LIHTC) and Historic Tax Credits (HTC). The primary driver is the need for additional resources in deals, making this somewhat cumbersome process more attractive. Under this structure, LIHTC depreciable and eligible basis are not reduced by the amount of HTCs and deals are able to generate significant additional resources.

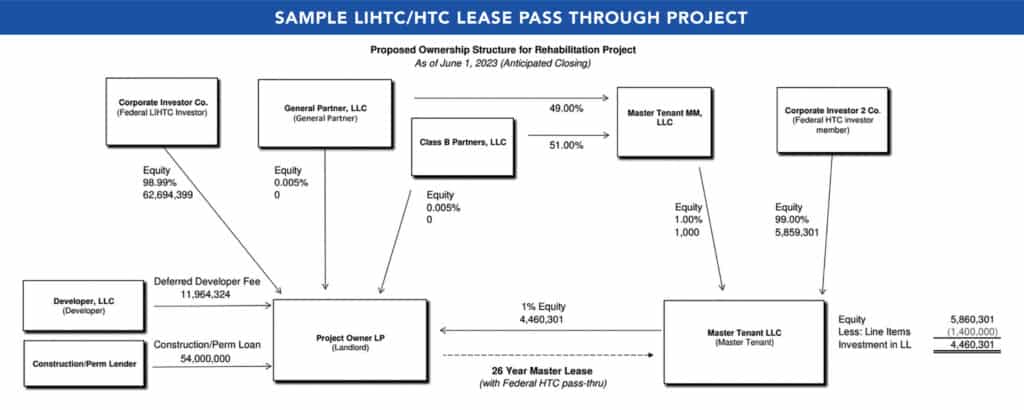

Of course, it comes with some drawbacks. The LIHTC and HTC investors have to be different; you can use the same syndicator, but the funds must be made up of different investors. The ownership structure is much more complicated (see chart) with the property owner required to pass through the HTCs to the master tenant. The master tenant then contributes the HTC equity to the landlord and is allocated one percent of the LIHTC.

The structure is typically recommended for deals with more than $10 million in HTCs and not recommended for nine percent LIHTC deals with substantial excess eligible basis to support its nine percent allocation. And of course, the added headaches, as well as legal and structuring fees, need to be worth it in the end. The presented case study was able to generate an additional $3.5 million compared to the standard single-tier LIHTC/HTC deal. Under the right circumstances, the added benefits may well outweigh the drawbacks in today’s development environment.

I expect we’ll see many more of these transactions over the coming months as deals become harder and harder to pencil. I’m curious to see what other relics of the past will re-emerge as everyone sharpens their pencil and gets a bit more creative.

A recording of their presentation is available in NH&RA’s On-Demand Learning Center and the slides are available at: https://www.housingonline.com/wp-content/uploads/2023/10/FDF23_Day.pdf. Nick and Katie cover the topic in greater detail and highlight several important operating, tax and legal considerations.