The Art of Structuring Deals as Master Lease Pass-Throughs

By Nushin Huq

7 min read

Twinning LIHTC and Historic Tax Credits

As skyrocketing construction costs and increasing interest rates have driven the need for more capital, affordable housing developers are expressing an increased interest in the master lease pass-through structure in deals involving a combination of Low Income Housing Tax Credits (LIHTC) and Historic Tax Credits (HTC). (This topic was introduced in Industry Insights, Tax Credit Advisor, November 2023.)

Structuring deals as master lease pass-throughs can be complicated and most deals are still the traditional single tier, but when the deal is large and every dollar of capital matters, a master lease pass-through can help larger affordable housing deals that also use the HTC.

“We’re in an environment where we need to raise as much capital as possible to close financing gaps,” Nick Ratti, principal at CohnReznick, told audience members during a panel discussion at National Housing & Rehabilitation Association’s Fall Developers Forum in October 2023. “When you’re doing a preservation project or an adaptive reuse of a mill or other historic property, it can be a powerful tool.”

“While it is difficult to quantify the increased interest in this structure in terms of the number of deals, prior to last year, CohnReznick’s clients were rarely using the master lease pass-through. Now, the national accounting and tax firm has clients with several projects in their pipelines that will be utilizing the master lease pass-through structure,” Ratti tells Tax Credit Advisor.

“Additionally, there has been a spike across the firm in the number of questions we are getting about the master lease structure, which also is indicative of an increase in the use of the structure in the industry,” Ratti says.

The master lease pass-through structure was used probably with some regularity many years ago, and then fell out of favor, said Katie Day, senior counsel at Klein Hornig LLP, during the same NH&RA panel discussion. Klein Hornig is also seeing a resurgence of the structure being used in deals that twin, or combine, the LIHTC and HTC.

“We’ve closed one deal, we’re about to close another and then we have a third in the pipeline,” Day said. “Those three deals have come to fruition in the last six months to a year. So, we have been seeing this pop up with increasing frequency.”

“The current spike in interest is primarily driven by the need for more capital because of skyrocketing construction costs and interest rates, among other things,” Ratti says. “For states with little or zero soft funds to fill financing gaps using the master lease pass-through can be a good alternative.”

“Typically, I only advise clients to use the master lease structure if they have exhausted all other avenues to fill out the capital stack and make their projects feasible,” Ratti says. “It is another tool in the toolbox for developers to turn to as a gap filler for their projects.”

How it Works

Under a master lease pass-through structure, the LIHTC investor can avoid a basis reduction – a consequence of combining, or twinning, LIHTC and HTC. While master lease pass-through may help LIHTC investors close financing gaps, it comes at the cost of dealing with a more complicated structure.

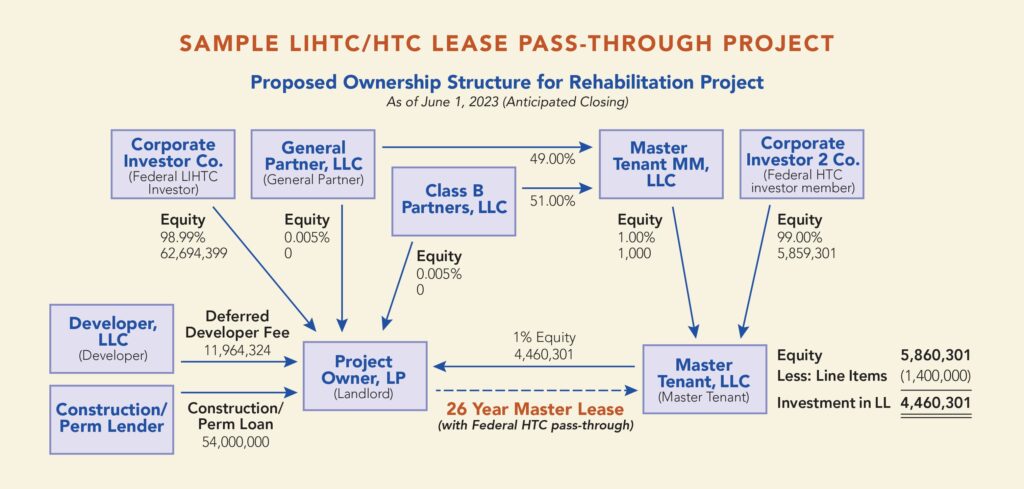

There are two entities in a master lease pass-through structure – the project owner and the master tenant. The project owner, or landlord, is responsible for rehabilitating the property and incurs the qualified rehab expenditures. The master tenant operates the property, collects all the rental revenue from tenants and pays most of the operating expenses.

In this pass-through structure, there are distinct investors—the LIHTC and HTC investors—Day explained during the panel discussion. The LIHTC investor typically owns a 98.99 percent interest in the landlord entity and contributes equity to the Federal LIHTC. A separate Federal HTC investor owns 99 percent of the interest in the tenant and contributes the Federal HTC equity to the tenant.

The tenant also typically owns a one percent interest in the landlord project owner and contributes the Federal HTC equity to the landlord, which the landlord will need to rehabilitate the project. The project owner, the landlord, will then make a tax election to pass through the HTCs to the tenant and the tenant can then claim those HTCs.

The major benefit of the master lease pass-through structure is that the project owner is not required to reduce depreciable or LIHTC eligible basis by the amount of the Federal HTC, Day said. In exchange though, the Federal HTC investor is required to amortize the Federal HTC and income over the shortest applicable depreciable period, which is generally 27.5 years in a residential project.

Day noted that LIHTC and HTC investors must be distinct under the master lease pass-through structure.

“If the investor is both the landlord and the tenant that is abusive because the only purpose of sort of utilizing that structure is to avoid the basis reduction,” Day said. “That doesn’t mean you can’t use the same syndicator, but the funds have to be made up of different upper-tier investors.”

On the other hand, in the more common single-tier structure, there’s one project owner entity that incurs the rehab costs. That entity constructs or rehabilitates the property, as well as operates the property, Day said. In this scenario, the federal investor is allocated both the LIHTC, as well as the HTC – the typical LIHTC/HTC twinning deal.

It’s a straightforward and well-known structure, but the downside is that the LIHTC program requires a basis adjustment if a project owner uses the HTC. The project owner is required to reduce depreciable and LIHTC-eligible basis by the amount of the HTC.

For example, a project with qualified rehabilitation expenditures of $10 million generates $2 million in HTC.

If the LIHTC basis was originally $11 million for the project, the developer would have to lower the LIHTC basis from $11 to $9 million, offsetting the basis by the amount of HTCs.

Who Should Consider the Master Lease?

“While complicated, the master lease structure can appeal to investors who have traditionally only invested in LIHTC,” Ratti says. “They can use the master lease structure to only invest in the LIHTC while allowing the developer to bring in an additional investor to invest in the HTCs. Additionally, the elimination of the basis reduction increases the amount of depreciation deductions, which in turn can result in better yields for the LIHTC investor.”

For developers considering the master lease structure, Ratti advises it isn’t for all projects.

“There are fixed costs, such as additional professional fees and ongoing operational expenses associated with using the master lease structure as compared to the traditional single-tier structure,” he says.

For the benefits of the master lease structure to outweigh the additional cost and complexity, CohnReznick typically advises clients that a project should generate a minimum of about $2.5 million of HTCs, which equates roughly to an additional $1 million of LIHTC in a four percent transaction.

“The master lease structure also tends to work well for projects in Qualified Census Tracts (QCTs) and Difficult Development Areas (DDAs), as well as projects with a significant number of market-rate units since the HTC basis reduction has a relatively larger impact on the LIHTC generated in those projects because of how LIHTC is calculated,” Ratti says. “In a traditional single-tier structure, the HTC basis reduction is applied prior to the application of the 130 percent basis boost or the applicable fraction exacerbating the impact of that reduction on the amount of LIHTC that is produced.”

“The lease pass-through structure can be an extremely efficient tool to help projects with certain characteristics close financing gaps without tapping into other competitive scarce local, state and federal resources that can come with additional restrictions,” Ratti says.