The New Markets Tax Credit Progress Report 2023

By Pamela Martineau

7 min read

Trends Towards Increased Funding for Homeless Shelters, Food Banks and Social Services

The New Markets Tax Credit (NMTC), approved by Congress in 2000, is a critical element of financing for community projects and businesses in distressed communities. The NMTC allocates a 39 percent tax credit over seven years and is used in financing packages for investments in Community Development Entities (CDEs) with a history of making investments and loans in underserved areas.

This summer, the New Markets Tax Credit Coalition (NMTCC) issued its annual “New Markets Tax Credit Progress Report” (the Report) on the credit, outlining trends in the entities receiving the credit and highlighting stand-out projects that were beneficiaries of the credit in 2022. All told in 2022, the NMTC financed 297 projects in 40 states and the District of Columbia. CDEs leveraged $3.2 billion in NMTC allocations to build $6.7 billion in project investments in low-income communities.

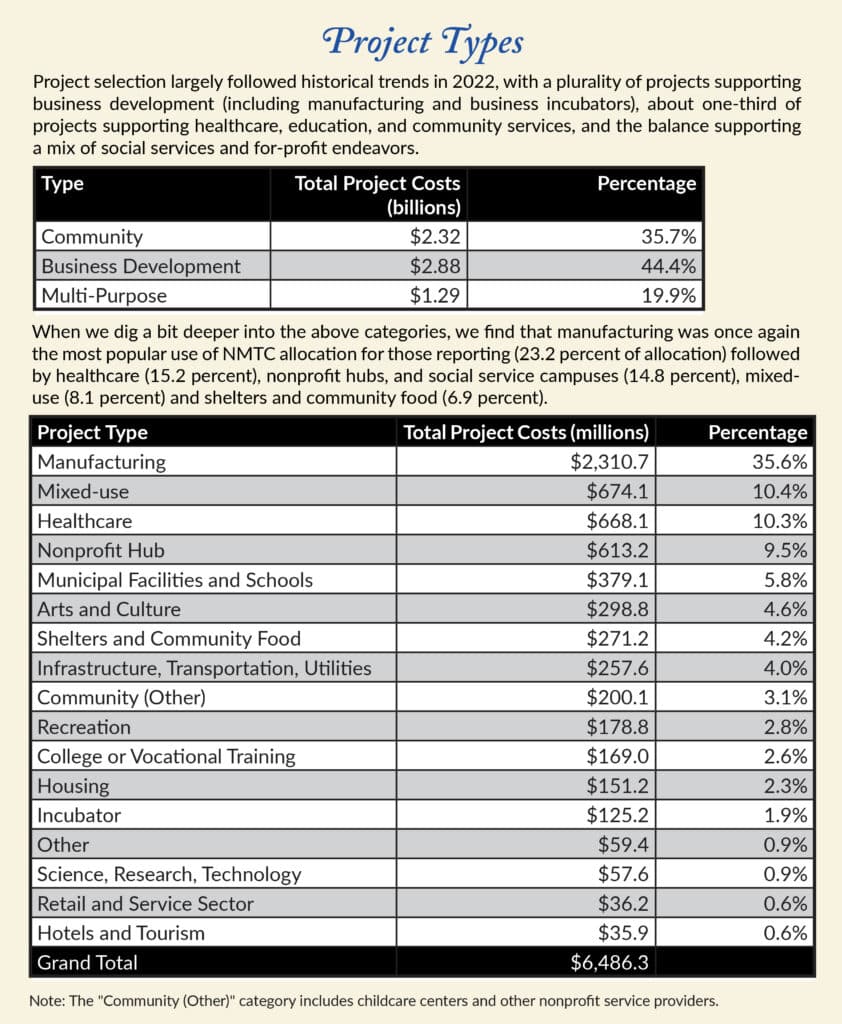

Here are some important highlights from the report. Top-line findings include the fact that manufacturing projects led the pack in overall investments – at $2.3 billion and 35 percent of the $6.7 billion in investments through the NMTC program. Mixed-use and healthcare projects followed as the categories of most invested in at $674 million and $668 million, respectively.

In recent years, allocations of the tax credit also have increased in social services projects. Investments in nonprofit hubs, homeless shelters and community food projects have increased by 584 percent and 278 percent, respectively since 2010.

“As homelessness and food insecurity increased over the past decade, CDEs have prioritized financing food banks, shelters and other facilities supporting our most vulnerable citizens,” the report reads. “Increasingly, these projects involved the co-location of social services…We have also seen an increase in projects supporting traditionally underserved populations, including Indigenous people.”

The report is based on survey responses from 60 CDEs, data from the Office of the Comptroller of Currency and other materials from NMTC-financed businesses.

Top Level Impacts from NMTC Projects in 2022

Investments made using the NMTC had a huge impact on communities throughout the United States in 2022, according to the Report. The projects created 52,822 jobs: 29,210 full-time and 23,612 construction jobs. The tax credit financing was used to renovate or construct 13.7 million square feet of real estate, including 3,054 homes targeting low- to moderate-income households and 4.8 million square feet in manufacturing space.

The tax credit also helped fund 138 educational programs, 98 manufacturing businesses and the expansion of 92 healthcare projects. Some 59 percent of projects were in communities of color and eight projects (2.7 percent) were in Indian Country or majority-indigenous census tracts.

“Food banks, pantries and community food programs financed in 2022 will facilitate an estimated 18.2 million meals to the food insecure,” the report reads.

Some 57 percent of the projects included affordable housing, at least one community facility and a nonprofit or social service component.

“These new community resources add up to 365 nonprofits, health centers, childcare centers, libraries, community centers and other community facilities and social service providers,” the report states.

How It Works

The NMTC is intended to provide gap financing for projects in underserved communities often underinvested in by traditional lenders. The tax credit is administered by the Department of the Treasury through its Community Development Financial Institutions (CDFI) Fund. The Treasury Department allocates the NMTC to CDEs and tracks their compliance. The CDEs must be domestic corporations with a mission of providing capital or serving low-income people or communities. The CDEs must submit a business plan to the CDFI Fund to receive the credit. If accepted, they may begin to seek equity investors.

According to the Report, which tracks 2022 investments, most of the tax credit investors are regulated financial institutions. They receive the 39 percent tax credit over seven years in exchange for their investments in a CDE. The CDEs then turn around and use the equity to provide low-cost capital loans to projects in eligible communities.

“Hospitals, incubators and manufacturers are common projects, but the program provides the flexibility to finance a variety of revitalization projects with support from leaders and residents of low-income communities,” the NMTCC report reads.

Types of Communities Targeted

The NMTC is designed to bolster investment in distressed communities typically underserved by lenders. According to the Report, some 30.5 percent of projects and 21.8 percent of 2022 project financing was in non-metropolitan counties that met the NMTC requirements.

The NMTC targets roughly 40 percent of the nation’s census tracts that meet requirements for economic distress, but most of the NMTC financing goes to severely distressed communities that exceed the program requirements for poverty. In 2022, that meant over 83 percent of investments went into communities with poverty rates over 30 percent and median incomes 60 percent below area median incomes. These communities had unemployment rates 1.5 times higher than the national average. In 2004, the NMTC statute was amended to ensure that a solid proportion of the CDFI funds are targeted in non-metropolitan counties.

Stand-Out Housing Projects

In 2022, the NMTC was deployed in funding packages that helped to create 3,054 affordable housing units and emergency shelters or supportive housing for some 54,373 people. Some of the stand-out housing projects include:

- Hundred Nights Emergency Shelter & Resource Center in Keene, NH. The project was funded through Evernorth Rural Ventures, a CDE, with investment from TD Bank. The project provides shelter and crisis-related services to people experiencing homelessness or who are at risk of homelessness. The tax credit was part of a financing package for the construction of a 15,180-square-foot, 48-bed emergency housing shelter and resource center;

- The Light of Life Support Corporation in Pittsburgh, PA. Funded through the CDEs – PNC Community Partners CDE and the Pittsburgh Urban Initiatives LLC with investment from PNC. The NMTC helped to finance the acquisition, renovation and expansion of a former school structure to create a 56,185-square-foot homeless shelter that also provides related services. Light of Life offers sleeping and bathing spaces, classrooms, dining areas, a kitchen, a food pantry and other amenities; and

- Our House in Little Rock, AR. Funded through Heartland Renaissance Fund CDE and equity investor First Horizon Bank. Our House launched a $16 million expansion of its 27,300 square foot facility to house 56 more residents in 14 new family housing units. The family housing units are intended to build space for homeless families to stay together. The project features apartment-style transitional units with shared kitchens and living spaces. The project also includes a new 20,000-square-foot family support center that is intended to serve as a hub for services for the clients, including case management, counseling and education and training.

NMTC Equity Pricing

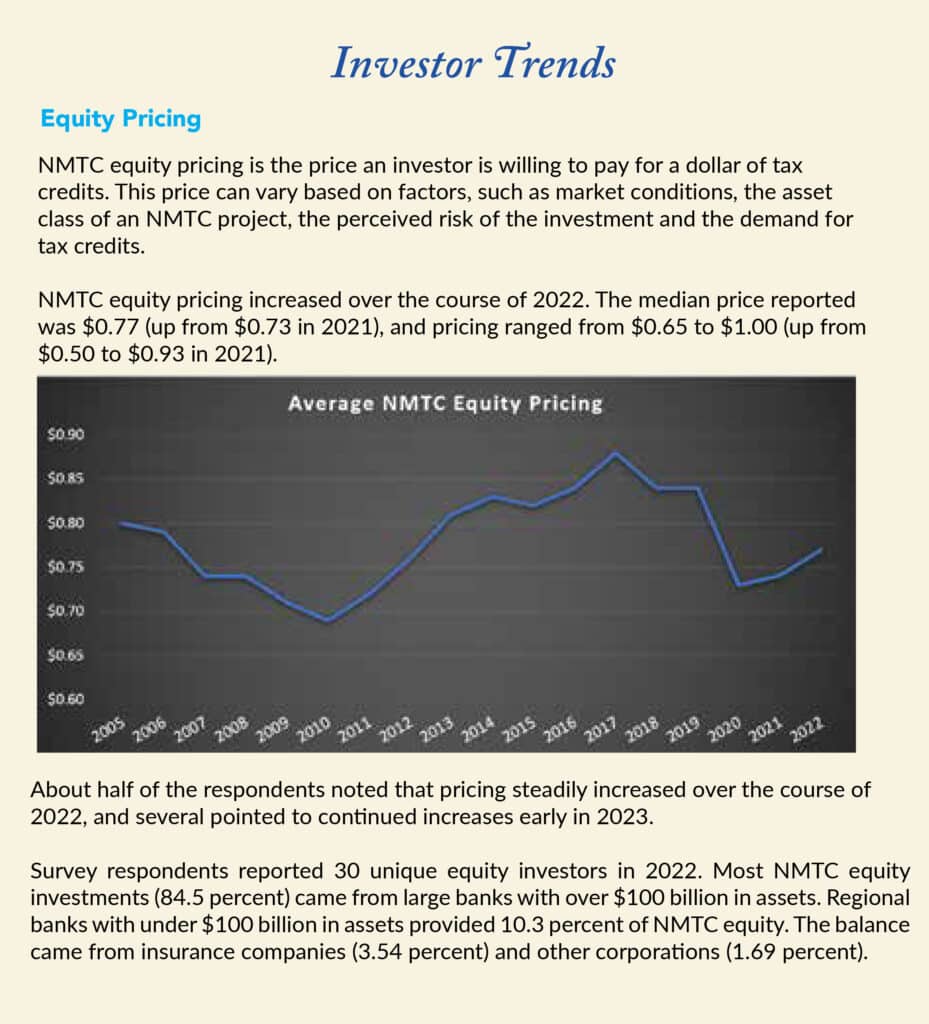

According to the Report, the price investors will pay for a dollar of the tax credit varies based on demand for tax credits, perceived risk of the investment and market conditions. In 2022, equity pricing for NMTCs increased. The median price was $ 0.77 for a dollar of tax credit, which was up from $0.73 in 2021. Prices ranged from $0.65 to $1.00, up from $0.50 to $0.93 in 2021.

“About half of the respondents noted that pricing steadily increased over the course of 2022, and several pointed to continued increases in 2023,” the report states.

Several survey respondents also reported that the increase in interest rates has necessitated boosting the amount of soft money, such as grants and government subsidies in funding packages.

Status of NMTC

Approved by Congress in 2000, the NMTC is not a permanent element of the tax code. Since its inception, the NMTC has been extended eight times. Its most recent extension was through the Omnibus and COVID Relief and Response Act of 2020, which extended the tax credit through 2025 at $5 billion in annual allocation authority. This was the largest extension in its history.

The current credit is scheduled to expire Dec. 31, 2025. A bipartisan bill, the New Markets Tax Credit Extension Act of 2023 (H.R. 2539 and S. 234) would extend the program indefinitely and expand the allocation level and investor base. The act is pending in Congress. The Senate effort for S. 234 is led by Senators Ben Cardin (D-MD) and Steve Daines (R-MT). The House effort for H.R. 2539 is led by Representatives Claudia Tenney (R – NY) and Terri Sewell (D-AL).