On June 29, 2011, the Maryland Department of Housing and Community Development (“DHCD”) issued an initial guidance memo regarding its approval of a new financing technique to facilitate multifamily rental development activity using tax-exempt housing revenue bonds and 4% Low Income Housing Tax Credits.

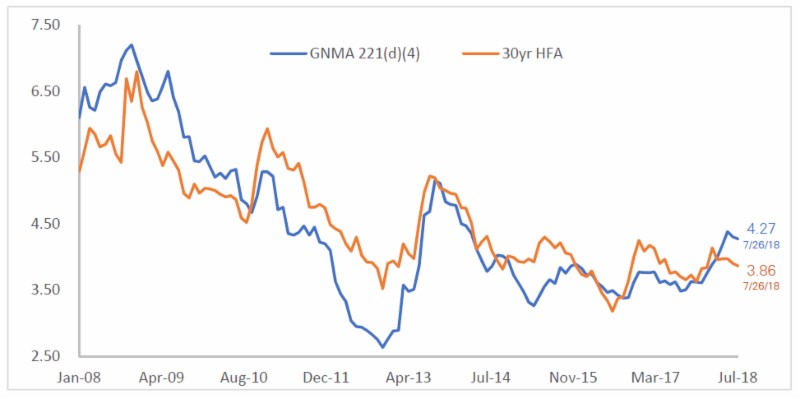

This approach (known as the “Taxable/Tax-Exempt Financing” technique) was initiated to enable qualified multifamily rental housing developments to realize lower long-term interest rates associated with taxable GNMA loan executions in conjunction with the Tax Credits available with tax-exempt bond issuances. As can be seen in the chart below, the long-term taxable interest rate (blue line) was significantly lower than the tax-exempt interest rate (orange line) in the 2010-2013 time period.

In September 2012, the first transaction using this financing structure was completed, and in the past six (6) years, numerous similar transactions have closed. By any measure, the use of the Taxable/Tax-Exempt Financing technique has been a success and has contributed (along with significant State investment through Rental Housing Works and other initiatives) to a record number of bond issuances and record levels of multifamily rental housing production.

Over the past several years, however, the long-term taxable and tax-exempt rates have become much more aligned (see chart, above). Most recently, taxable rates have moved higher than tax-exempt rates, which is a condition more consistent with the long-term nature of interest rates.

DHCD is seeking public comment regarding whether or not it should continue to offer the Taxable/Tax-Exempt Financing technique. DHCD recognizes that interest rates are not the only factor that drives the choice of credit enhancement, and we would like to receive input regarding other factors that should be included in any decisions made regarding this financing technique.

Please submit your comments for consideration by no later than Friday, December 14, 2018 to the following email address:

dhcd.rentalhousing@maryland.gov

All comments received by the deadline will be reviewed and taken into consideration by DHCD.

DHCD wants to emphasize that this request for comments in no way undermines its long-standing commitment to making available an array of financing alternatives to our customers, such as FHA/GNMA (221-d4, 223-f, etc.), Fannie Mae and Freddie Mac executions. This commitment is what led to the adoption of the Taxable/Tax-Exempt Financing technique in 2011.

If you have any questions, please email at john.maneval@maryland.gov or call at 301.429.7714.