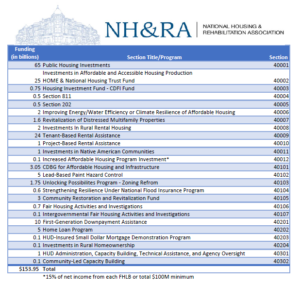

House leadership recently released an updated version of the Build Back Better Act, which now includes $153.95 billion in direct housing spending provisions, as well as several key LIHTC provisions:

- Increases the nine percent LIHTC per capita and small state minimum allocations by ten percent each year plus inflation for 2022-2024 and continues the inflation adjustment for nine percent LIHTCs for 2025 and thereafter (Section 135101);

| Calendar Year | 9% Credit Per Capita | Small State Minimum |

| 2022 | $3.14 | $3,629,096 |

| 2023 | $3.54 | $4,081,825 |

| 2024 | $3.97 | $4,582,053 |

| 2025 | $2.65 | $3,120,000 |

*Current allocation for 2021 is 2.8125 per capita

- Lowers the 50 percent financed by test for bonds and four percent LIHTC to 25 percent for 2022-2026 (Section 135102);

- Enables a permanent 50 percent basis boost for properties serving extremely low-income tenants (Section 135103) and a 30 percent basis boost for developments in Native American areas;

- Repeals Qualified Contracts for all properties receiving allocations after Dec. 31, 2021 and changes the current formula to fair market value, as determined by the Housing Credit Agency for existing properties (Section 135104);

- Makes several modifications to the Right of First Refusal (ROFR) by:

- (i) Converting the right to a purchase option for agreements entered into after passage;

- (ii) Allowing the inclusion of partnership assets related to the building in the definition of property;

- (iii) Allowing the option holder to exercise the right of first refusal without requiring the approval of an investor or requiring a bona fide third-party offer; and

- (iv) Changing the purchase price to only debt and not debt plus exit taxes. The changes are not intended to change any express provision in an existing agreement. (Section 135105).

- Allows Section 48 Energy Investment Tax Credit to be taken on a property without reducing the eligible basis for LIHTCs (Section 136103).

The bill also includes the Neighborhood Homes Investment Act (Section 135201), $25 million for Historic Tax Credits (Section 70707), $25 million for Factory-Built Housing (Section 40403), $9.75 billion for the Department of Transportation’s Affordable Housing Access Program (Section 110001), as well as energy and broadband incentives, which will impact housing.

While NH&RA and our partners are very excited both spending and tax provisions are in the bill, the bill still needs to be enacted. Please keep up the outreach – thank your members of Congress for including both affordable housing spending and tax provisions in the bill and urge them to vote in favor of the bill.